unified estate and gift tax credit 2021

The gift and estate tax. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117.

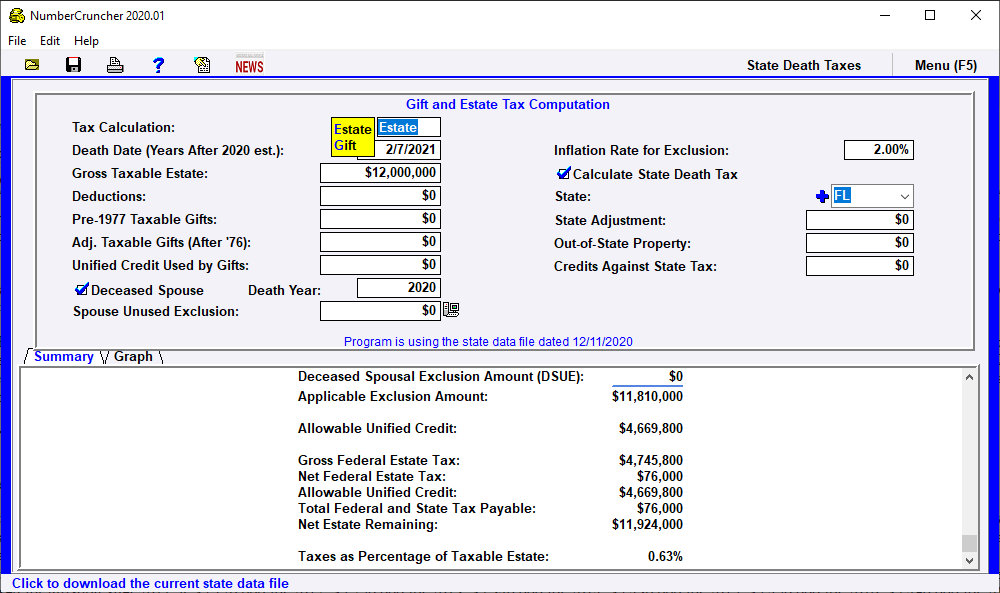

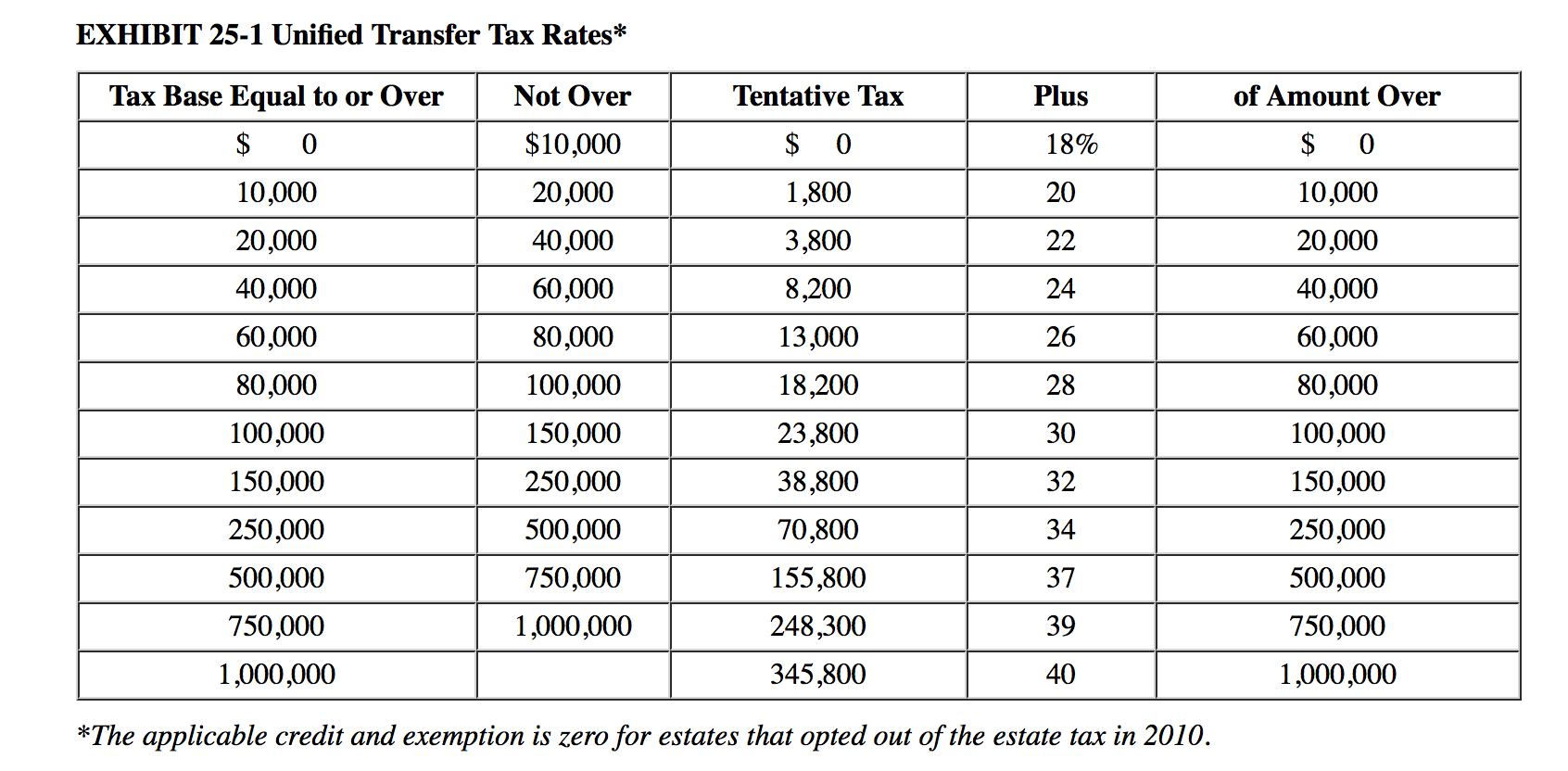

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

The unified tax credit changes regularly depending on.

. The unified tax credit changes regularly depending on. What is the unified tax credit for 2021. 2501 and following or under corresponding provisions of prior laws and thereafter on the death of the donor any amount in.

Tax and sewer payments checks only. Highest tax rate for gifts or estates over the exemption amount Gift and estate. Or of course you can use the unified tax credit to do a little bit of both.

Or of course you can use the unified tax credit to do a little bit of both. All people are qualified to take advantage of this tax perk from the Internal. This means that you can give 15000 every year to each of.

Or of course you can use the unified tax credit to do a little bit of both. A tax credit that is afforded to every man woman and child in America by the IRS. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

As of 2021 you are able to give 15000 per year to any. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

What Is the Unified Tax Credit Amount for 2021. Then there is the exemption for gifts and estate taxes. Property Tax DeductionCredit Eligibility.

As of 2021 you are able to give 15000 per year to any individual as a tax-exempt gift. If you die in 2022 after making such a taxable gift you will still be able to transfer. Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant during 2021.

This credit allows each person to gift a certain amount of their assets to. The gift tax and the estate tax. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

The new york estate tax threshold is 592 million in 2021 and 611 million in 2022. What Is the Unified Tax Credit Amount for 2022. If a tax on a gift has been paid under chapter 12 sec.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or. To pay your sewer bill on line click here. You are eligible for a property tax deduction or a property tax credit only if.

If you were both a. What Is the Unified Tax Credit Amount for 2021. Unified Tax Credit What is the Unified Tax Credit and Why You Should from.

Gift and Estate Tax Exemptions The Unified Credit. A unified tax credit allows you to gift assets without having to pay transfer taxes in some cases. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. A person giving the gifts has a lifetime exemption from. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit. The Estate Tax is a tax on your right to transfer property at your death. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

No cash may be dropped off at any time in a box located at the front door of Town Hall. Most relatively simple estates cash publicly traded securities small. Unified Tax Credit.

Your available Unified Credit is effectively reduced from 1206 million to 12 million.

The Future Of The Unified Tax Credit And Potential Strategies Cba S Thebar

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

The Applicable Credit Against The Estate And Gift Tax

Estate Tax Bb R Inc And Buckman Advisory Group Llc

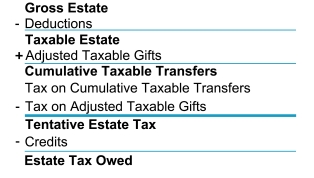

Julia A Widow Died In 2021 With A 12 5 Million Chegg Com

Opinion Favorable Federal Gift And Estate Tax Rates Probably Won T Last Forever Here S What To Do To Prepare Marketwatch

What Is The Unified Tax Credit For 2021

How To Utilize The Gift Tax Annual Exclusion Buchbinder Tunick Co

The Evolution Of Our Unified Estate And Gift Tax System

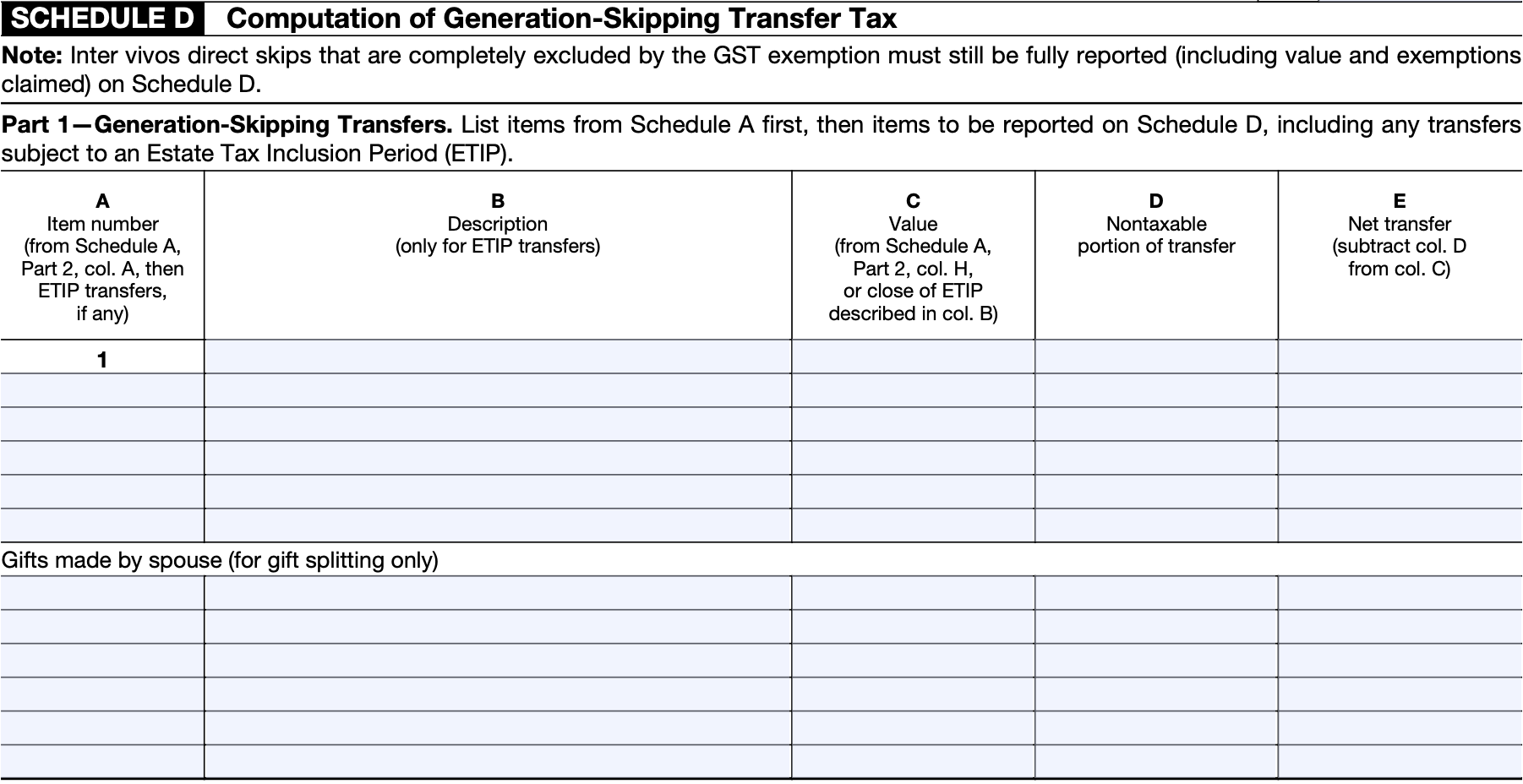

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

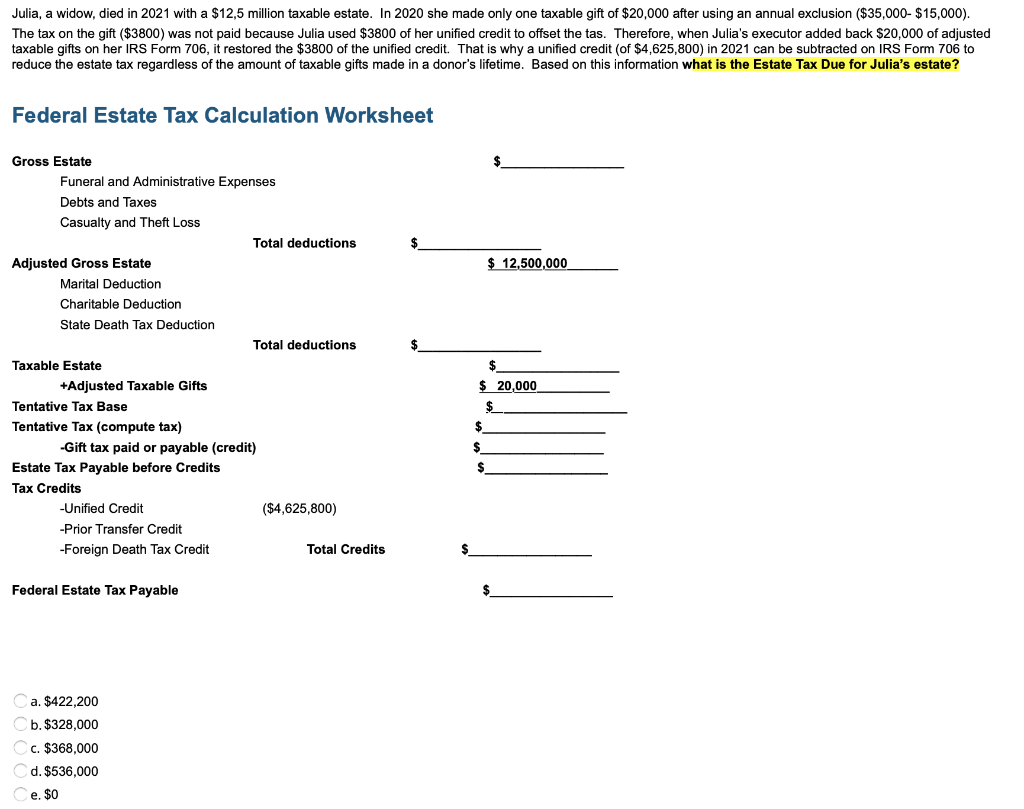

Exploring The Estate Tax Part 1 Journal Of Accountancy

Exploring The Estate Tax Part 1 Journal Of Accountancy

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Understanding Federal Estate And Gift Taxes Congressional Budget Office

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Year End Gifts And The Gift Tax Annual Exclusion Sol Schwartz

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com